by Vanessa Diem

Can you place the palm of your hands up, a little distant from your eyes? Do ensure your fingers are glued together. What did you notice? For sure, the first thing that comes to mind is the differing length of the fingers. That explains everything! Life is in facets and not all fingers are equal. So, this simply means we have different categories of people.

Contents

With that in mind and not waving from our soul aim. Which is, to make you a better version of you. We would be looking at how to help people with low income obtain credit cards. Definitely, we all know how invaluable a credit card can be.

Also, we all know how difficult it is for people in the lower class to successfully obtain a credit card. Most times, it's as difficult as pushing a dead truck forward. Yes, we are all aware that the least wage is about $7. Nevertheless, some people-employees, families and other whatnots, still encounter troubles meeting up with the laid down criteria for obtaining a card(credit card to be precise). The banks are in charge of putting out these criteria.

Before we proceed, let's spell out those laid down requirements for better understanding:

1. Age : To obtain a credit card, one has to be at least twenty-one years of age. For someone not up to that age, say eighteen years of age. You'd be needing a letter of permission from your parents and/or ward. Or, if that isn't feasible, a valid income source will be requested.

Contents

2. Social security number: It is actually a number, just like your matriculation number, very unique to you. SSN, for short, consist of 9 digits imbibed by the authorities of the United States of America. It is given to every bona-fide son of the soil. That is citizens. The citizenship could be by birth, or any other legal process. It is known that a ruling body or government won't put anything in place for no reason. So, the sole purpose of the U. S governing body to bring this up is basically to monitor every person's turnover or income plus the length of time the person work. SSN(Social Security Number) can be likened to NIN( National Identification Number) used in Nigeria.

3. Source of income : Before a bank issues out a credit card to a prospective client, you are been requested to pen the amount of income you generate in a month. It isn't of necessity to drop all you make on a monthly basis. You're meant to drop what is available and able to pay into your credit card.

4. A good track record when it comes to credit history.

Out of everything listed above here, the topmost one that gets the attention of the bank the moment you put in for credit card is no other thing than what you earn( your income ). The moment the bank representative(s) notice it's not favorable, the application is rejected. Thus, no card is given or issued.

God so good, we have one or two bank settings that flow with the fact that all fingers are not equal and not every person you see has amassed a lot of income. For this reason, a unique type of credit card(s) are made available for people earning a very small income.

On this very platform, today, we'd be discussing these types of credit cards, best for people running on a very small income. So, don't touch the back button!

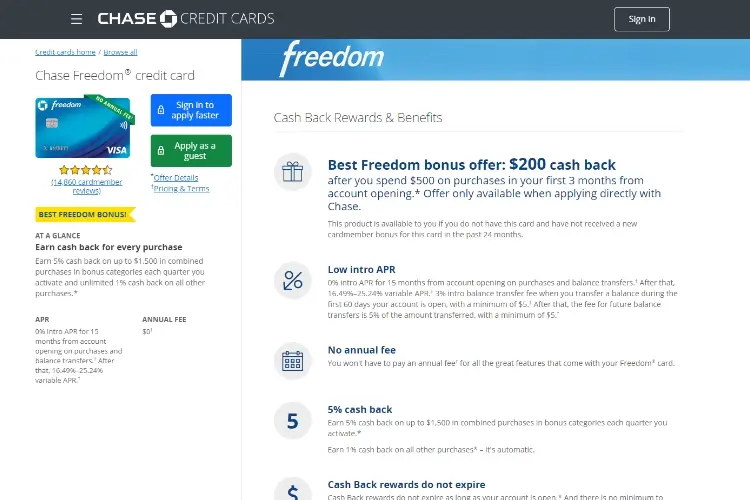

When you talk of a perfect mix or an answered prayer, here it is! It's OK as young adults and even employees and/or casual workers with a low pay can settle for it. Are you making, let's say, twenty-five hundred dollars annually? You can go for this type of credit card.

What do you stand to gain from using Chase freedom?

1.Nothing like a fee to be paid annually

2. You have cash back: You have at least two different cash back to your advantage. Receive five percent when you get things summing to a thousand and five hundred dollars. This happens every three month, the moment you do your activation. You also have the automated one. The one percent cash back. Please, take note, no expiration date attached to these cash back. Just ensure the account is left open. Plus, the cash back policy doesn't come with any minimum cash you have to withdraw.

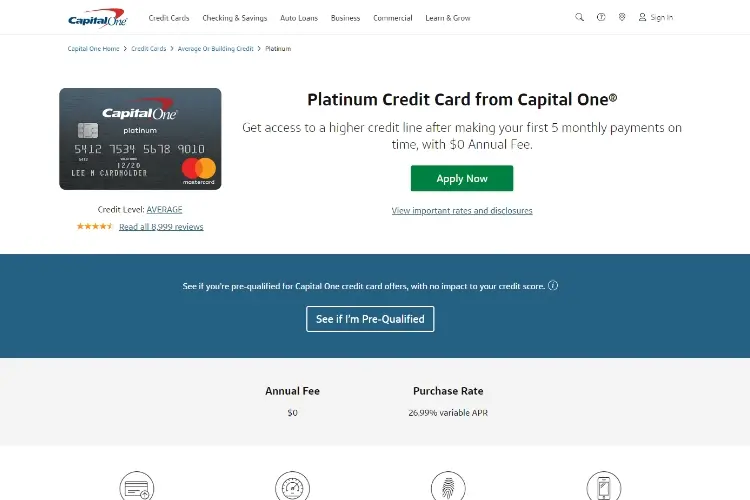

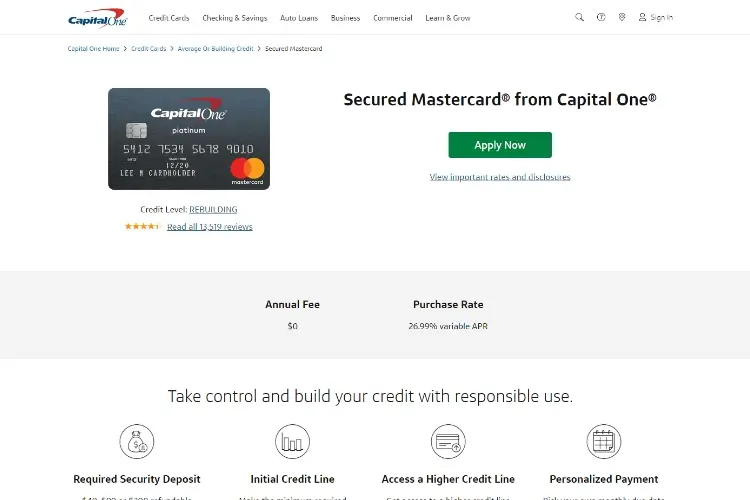

This credit card type is also one to give close attention to. It gives a wide range of cards and they are quite affordable. It pays, especially for workers with small income. It helps in areas like protecting against fraudulent acts, even no yearly fee or charge. There's room for getting access to this credit card type online.

At this point, let me mention that as soon as you activate your card, you begin, compulsorily with a limit to the card. Though, very low. Then, when twenty weeks has gone by, that is five months, you are free to push for a credit. That's if you have been consistent with your payments.

Some things you need to know about capital one(Platinum) :

1. Annual charge or fee isn't applicable here.

2. You have no cause to fear or fret when your credit card goes missing.

3. Straight from your mobile device, you can access the platform from their App. As long as you have an account.

4. Several payment modalities. Online, via cheque or through the their local outlets. They all come with service charge. Just select the due date(on a monthly basis) suitable for you.

5. Freedom to get through to your profile without time restrictions.

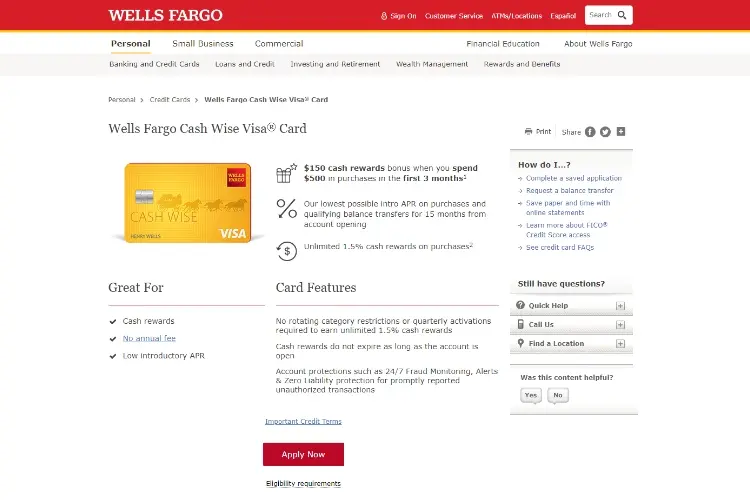

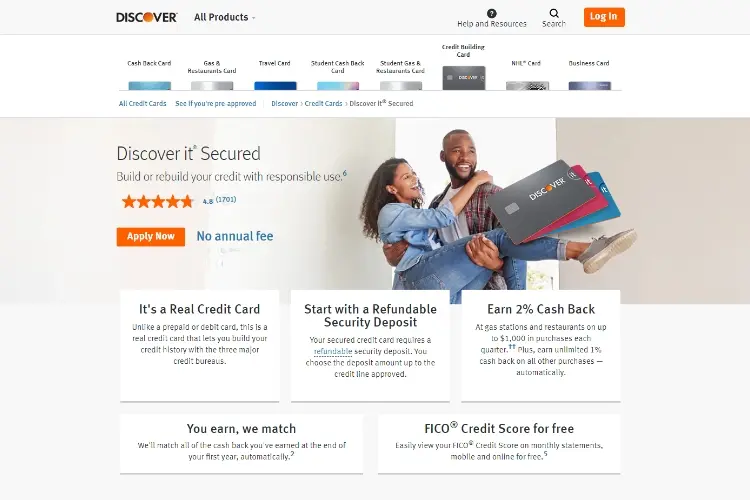

This type brings some goodies. Not to forget, nothing like yearly charges or fee. With this card, you can;

1. Get stuff and send cash during the first year, free of charge. No form of interest on it.

2. Enjoy cash back too. For example, you can get about one and half percent cash back on all your trades. Even a cash back of more than five hundred dollars in a situation where your device is damaged or missing.

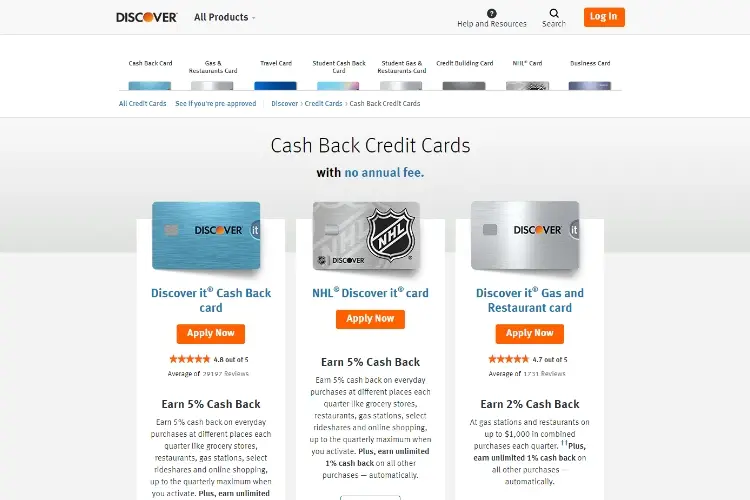

Are you a student or you earn about fifteen thousand dollars annually? If yes, you might be interested in this type of credit card. With the card, you can cash back, up to five percent in some specific places. Every other one goes with just one percent.

The following card types can be categorized as phase 2. The title 'secured' is not really much of a big deal. It only depicts that these particular card types are supported by making payment in it before time. People with small income might not really go well with this. However, the truth is, it's one good pathway to get started with credit cards. This is simply because security is pretty sure in this case.

Usually, the moment you begin to use a card like this, any deposit you make into the account stands as the limit. Funny right? Well, credit limit can be made to increase simply by putting more cash in it. But, you ought to drop the whole money in the account at the close of the month(applicable to every month). It's advisable you show good commitment to this as the card issuer can later release an unsecured one to you.

So, in this secured category, we have:

All features consistent with others mentioned above are available with this card too. The likes of:

1. No yearly charge

2. Ability to access it online

But, there should be more to it, since it's secure right? Yes, you're right. To add more juice to the mix, it gives:

1. Updates and/or notifications on the day-to-day happenings on your account.

2. Great customer care services.

Not a bad idea if getting a secured card is your topmost desire.

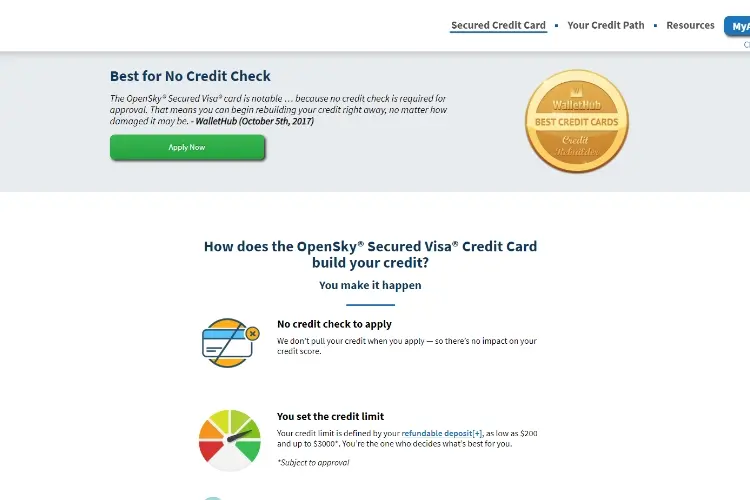

For those that do not really have a high rating in terms of credit, gather here for a selfie! You'd like this, I'm sure. The good thing is the fact that card issuers(banks) don't really put much attention to credit rating when you put in for this type of card. In other words, The review process is devoid of credit rating. However, you will still have to hint the issuers on yearly income during the application process. There's no way you can escape this.

But, one little drawback. The yearly payment is about forty dollars. That's for card service.

The game play here is a little different from what we've been having. The least deposit you can make at the beginning is $200, nothing less. Calm down, it's just for a while. You'd be able to retrieve your cash in less than a year. To be more factual, it'll be after eight months. Now, your question may be- what exactly do I stand to gain from it? OK, see below:

1. Yearly fee not applicable.

2. Cash back guaranteed. Two percent cash back on trades made in eateries and fuel stations to be precise.

You see, it's still OK for low income earners.

Learn more about it in this video:

Before we bring everything to a close, let's quickly run through simple nuggets to obtain a credit card.

1. Take note of your credit rating

2. Give honest information all through the application and reviewing process

3. Liase with a responsible person and make the person vouch for you.

Enough is enough! No more rejections and disappointments. Apply all these tips we've packaged for you and share the good news with us in the comment box right down here.

About Vanessa Diem

Vanessa Diem is a finance blogger who has gained widespread recognition for her insightful and informative content on personal finance, investing, and money management. With a keen understanding of the complexities of the financial world, Vanessa is dedicated to providing her readers with practical advice and strategies to enhance their financial well-being.

|

|

|

|

Good Topics 4 Ya

Something wrong. Try FREE CC Giveaways. Or go to Free Gifts

Disable adblock to see the secrets. Once done, hit refresh button below for fun stuff

|

|

|

|